- Unemployment- the percentage of people who don't have jobs that are in the labor force

- Unemployment rate = #unemployment ➗#in labor force ✖ 100

- labor fore = Unemployment = employment

- standard unemployment is 4-5%

- people not in the labor force

- kids

- military personal

- people in mental institutions

- home makers

- retired people

- full-time students

- people in jail or prison

- discouraged

- 4 types of unemployment

- Frictional Unemployment

- "Temporarily Unemployment" or being between jobs

- individuals are qualified workers with transferable skills but they aren't working

- Seasonal Unemployment

- this is a specific type of frictional unemployment which si due to time of year and the nature of the job

- these jobs will come back

- Structural Unemployment

- Change in the structure of the labor force make some skills obsolete

- Workers don't have transferable skills

- Cyclical Unemployment

- as demand for goods and services falls, demand for labor falls and workers are fired

- The natural rate and fall employment

- two of the three types of unemployment are unavailable

- frictional

- structural

- Together they make up the natural rate of unemployment

- frictional + Structural = NRU (4-5%)

- full employment means no cyclical unemployment

- okun's law- when unemployment rises 1% above the natural rate, GDP fall by 2%

- People that are employed

- Part time workers

- people on a leave of absence

- people who work 1 hour a month

Monday, February 13, 2017

Unit 2- February 9

Unit 2- February 2

- Inflation- an increase or rise in price

- Purchasing power- the amount of goods and services that your money can buy

- three causes of inflation

- printing too much money

- demand-pull inflation

- it is caused by and excess of demand over output that pulls prices upward

- cost-push inflation- it is caused by a rise in per unit production cost due to increasing resources cost

- inflation rate formula- current year price index - base year price index ➗ base year price index ✖ 100

- Rule of 70- it is used to calculate the number of years it will take for the price level to double at any given rate of inflation

- 70 ➗ annual rate of inflation

- the ideal inflation rate should be 2-3%

- Deflation- a general decline in price level

- Disinflation- occurs when the inflation rate declines

- Nominal interest rate- the unadjusted cost of borrowing a lending money

- Real interest rate- the cost of borrowing or tending, adjust for inflation

- Nominal - Expected inflation

- Hurt by inflation

- lenders-people who lend money (at a fixed interest rate )

- People with fixed income

- Savers

- Helped by inflation

- Borrowers- people who borrow money

- a buisness where the price of the product increases faster than the price of resources

Sunday, February 12, 2017

Unit 2- February 3

- Nominal GDP- the value of output produced in current prices

- it can increase from year to year if either output or prize increases

- Real GDP- the value of output on constant base year prices

- it adjust for inflation

- it only increases if output increases

- formula is P * Q

- use real GDP to measure economic growth

- in the base year real GDP and Nominal GDP are equal

- in years after the base year nominal GDP will exced real GDP

- in years before the base year, real GDP will exceed nominal GDP

- GDP Deflator- a price index used to adjust from nominal to real GDP

- nominal GDP ➗ Real GDP ✕ 100

- in the base year GDP Deflator will always equal 100

- for years after the base year GDP deflator is greater than 100

- for years before the base year GDP deflator is less than 100

- Consumer price index( CPI )- it measures inflation by tracking changes in the price of a markets basket of goods

- Price of market basket in the current year ➗Price of market basket in the base year ✕ 100

Unit 2- January 31

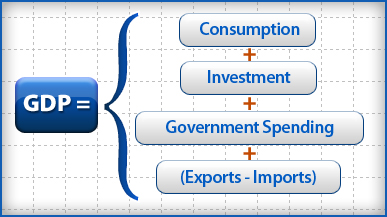

- Expenditure approach to GDP

- expenditure is spending

- Income approach to GDP

- Wager rents interest profits + Statistical Adjustments

- Trade = Exports - Imports

- Budgets= government purchases of goods and services + government transfer payment - government tax and fee collection

- if the number is positive its a deficit, if its negative its a surplus

Unit 2- January 30

- GDP- Gross Domestic Product

- The total value of all final goods and services produced within a country's borders within a giving year

- GNP- Gross national product

- The total value of all final goods and services produced by americans in a given year.

- GDP= C + Ig + Xn

- C- Consumption ( Includes the purchases of final goods and services)( 67% of economy)

- Ig-Gross Private Domestic Investment (18% of the economy) (Includes new factor equipment, factory equipment maintenance, construction of housing, unsold inventory of product build in a year)

- G- Government spending (17% of the economy) ( government purchasing goods and services)

- Xn- Net exports (exports - imports) ( -2% of the economy)

- Included in GDP

- C, Ig, G, Xn

- Excluded in GDP

- Intermediate goods

- adding double or multiple country

- Second hand goods

- avoiding double or multiple counting

- Stock and Bonds

- no production involved

Unit 2- January 26

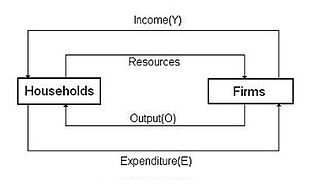

- Circular flow model- it represents the trade of an economy by flows around the circle

- Household- a person or group of people who share an income

- Firm- An organization that produces goods and services for sale

Subscribe to:

Posts (Atom)